Posted on Saturday, January 3, 2026

As we reflect on 2025, the Lancaster and Morecambe property market has once again shown its resilience. After several years shaped by rising interest rates, economic uncertainty and legislative change, 2025 felt calmer and more settled. Not without its challenges, but noticeably more predictable.

National headlines often paint a dramatic picture, but locally our market tends to behave differently. Rather than sharp rises or falls, we’ve seen steady adjustment and continued movement — provided homes were priced sensibly from the outset.

This annual round-up looks at what really happened in the Lancaster and Morecambe housing market during 2025, using local data to highlight the key trends shaping the outlook for 2026.

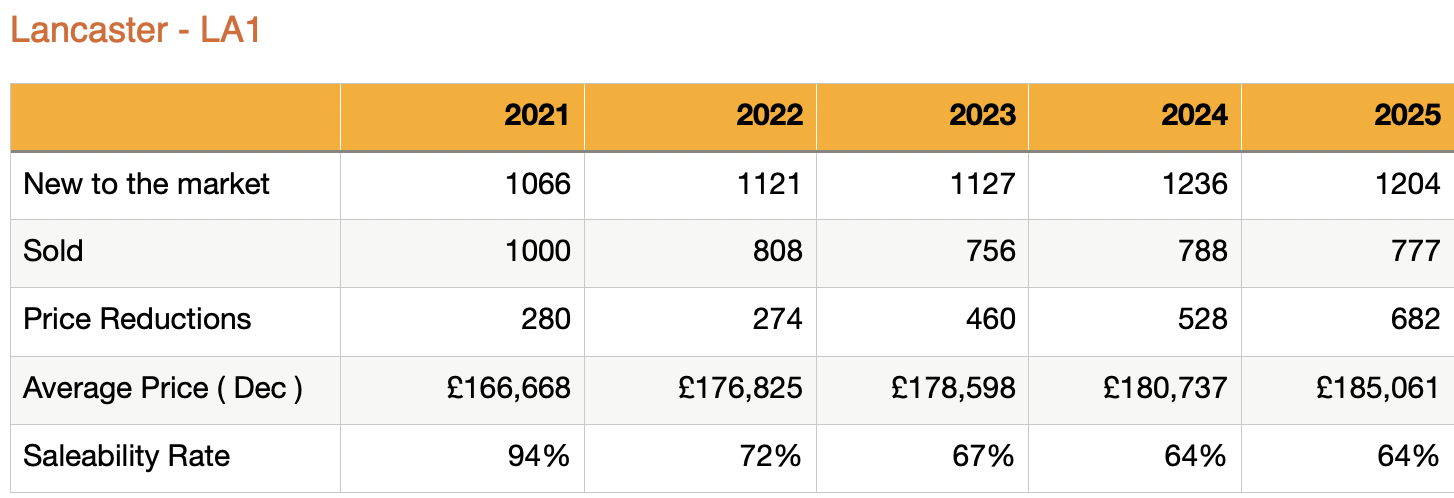

In Lancaster (LA1), 1,204 homes came to market during 2025, slightly down on the previous year but still healthy by longer-term standards. Sales remained consistent, with 777 homes sold, confirming that buyer demand is still very much present.

What has become more noticeable is the increase in price reductions, which rose to 682 during the year. This isn’t a sign of a struggling market, but a realistic one. Buyers are informed, have choice, and are prepared to wait. Homes that launched at the right price sold well, while those that didn’t often needed adjustment.

Average prices in Lancaster finished the year at £185,061, up from £180,737 in December 2024. Growth has been modest rather than dramatic — something we view positively. Stability builds confidence, and confidence encourages movement.

Saleability remained at 64%, the same level seen in 2024, showing a market that has found its rhythm but now demands accuracy rather than optimism on price.

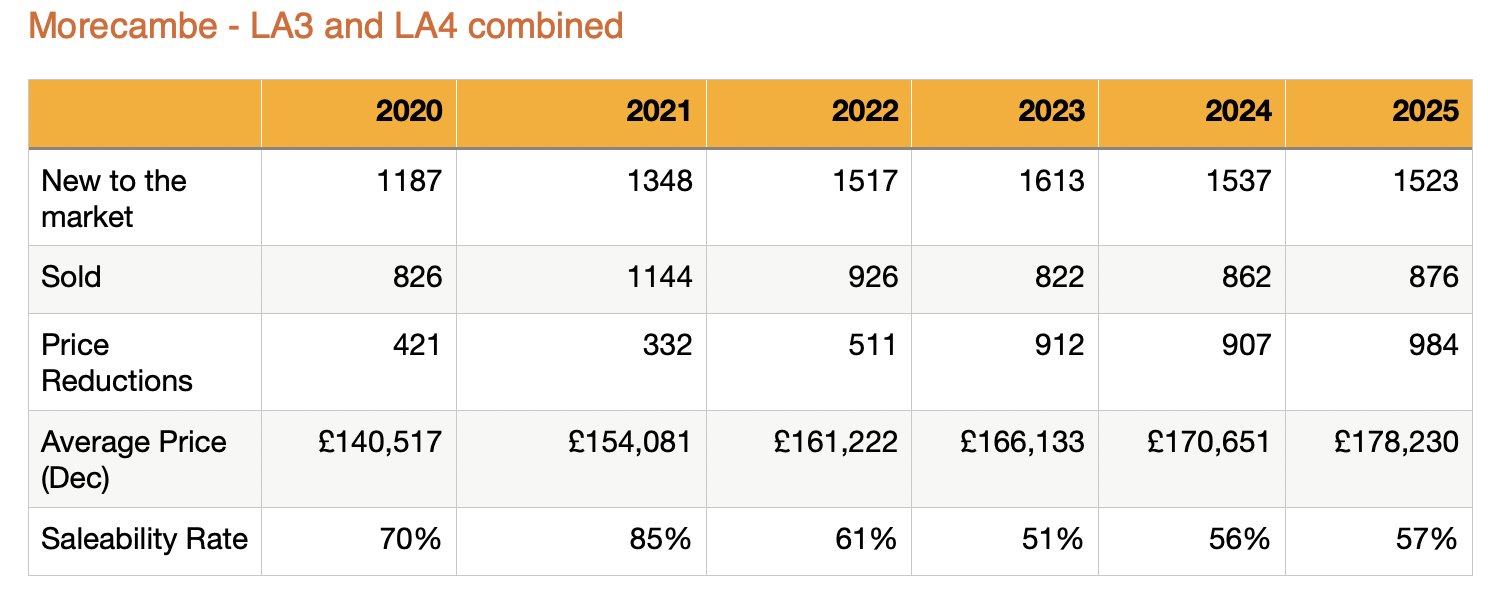

Across Morecambe (LA3 and LA4), 1,523 homes were listed during 2025, broadly in line with last year. Sales edged up slightly to 876 homes sold, which is encouraging and shows continued demand.

Average prices rose to £178,230 by December, continuing a steady upward trend. However, price reductions reached 984, reinforcing a familiar message — buyers have choice, and pricing correctly from day one makes all the difference between selling smoothly and chasing the market.

When we look at average prices across both Lancaster and Morecambe, the overriding theme is stability. Growth has been modest rather than dramatic, which is exactly what supports confidence and longer-term market health.

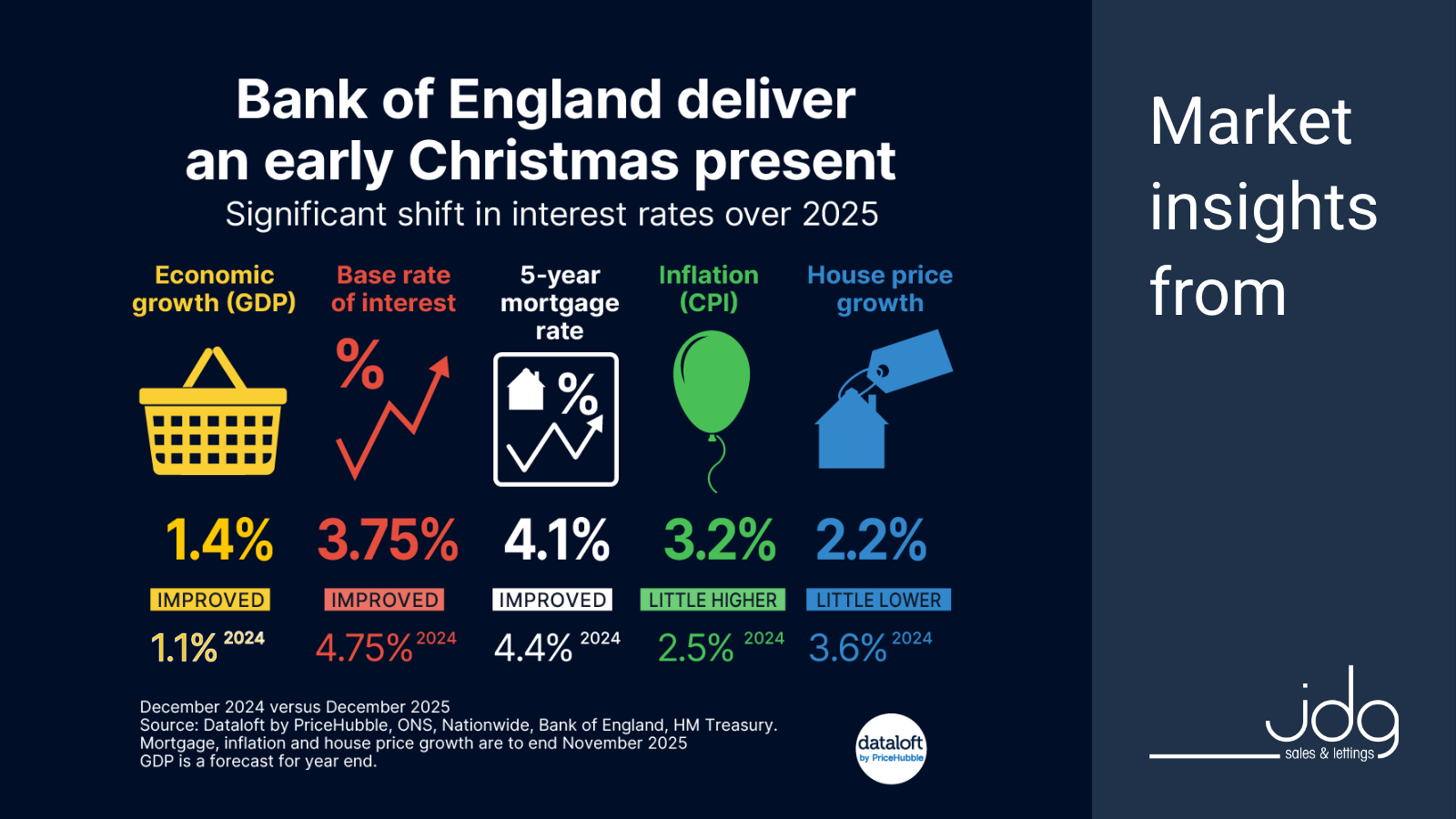

From a wider economic perspective, 2025 delivered some welcome improvements. The Bank of England base rate reduced to 3.75%, down from 4.75% a year earlier, helping ease borrowing costs. Average five-year mortgage rates settled around 4.1%, improving affordability for many buyers.

Inflation, while slightly higher at 3.2%, remains far more manageable than in recent years, and wage growth alongside modest economic expansion has helped rebuild confidence.

For the first time in a few years, 2026 is shaping up to be a more favourable year for first-time buyers. Lower mortgage rates have improved affordability, and the continued stamp duty exemption on purchases up to £400,000 removes a significant upfront barrier.

At JDG, we’re seeing more first-time buyers registering early, getting mortgage-ready and feeling confident enough to view rather than wait. Choice is better than it has been, and while competition still exists for well-priced homes, buyers no longer feel rushed into decisions. It’s a healthier, more balanced environment.

There’s also renewed confidence among property investors as we move into 2026. With the Renters Reform Act 2025 now clearly set out, landlords finally know what’s changing and, importantly, when.

That certainty matters. Over the past couple of years, uncertainty caused many investors to pause. Now, we’re seeing more proactive conversations — landlords reviewing portfolios, planning improvements and making informed decisions rather than reacting to speculation. Demand for good-quality, well-managed rental homes across Lancaster and Morecambe remains strong.

As we move through 2026, the outlook is quietly optimistic. Forecasts from major industry commentators, including Zoopla and Rightmove, suggest similar transaction levels to 2025, with no expectation of sharp rises or falls in activity.

In terms of pricing, a wide range of expert sources are predicting modest house price growth of around 1.5% to 2% over the year. This reflects a market that continues to adjust rather than overheat — a pattern that suits the Lancaster and Morecambe area well.

For buyers, this points to continued opportunity. For sellers, it reinforces the importance of pricing accurately from the outset. Growth is expected, but it will reward realism rather than optimism.

Across every sector, one message remains consistent. This is a price-sensitive market. Sellers want to sell. Buyers want to buy. But buyers are informed, patient and selective.

When price, presentation and promotion are aligned, homes continue to sell well. When they’re not, the market gives feedback quickly. As we always say at JDG — sensible pricing is key.

Thank you, as always, for reading and for trusting us to keep you informed. If you’re thinking about moving in 2026, or simply want an honest conversation about the market, we’re always here to help.

Happy New Year,

Michelle, John, Boots and all at JDG x

P.S. We continue to share real sales as they happen on our Facebook page — because transparency matters.

P.P.S. If you’d like these updates emailed directly to you throughout the year, just let us know.