Posted on Sunday, January 1, 2023

2022 started with a bang. Homes which offered versatile living were still in high demand as many workers started to see the benefits of flexible working spending time both working from home as well as in the office. Mortgage rates were still very low and the number of buyers looking online was over double what we were seeing 12 months earlier!

As the winter turned into Spring, it soon became apparent that the housing market was set to slow as the cost of living crisis started to creep in, exasperated by the War in Ukraine. Nobody thought could have predicted Liz Truss and the ill-thought-out mini-budget in September which pretty much changed the pace of the housing market overnight.

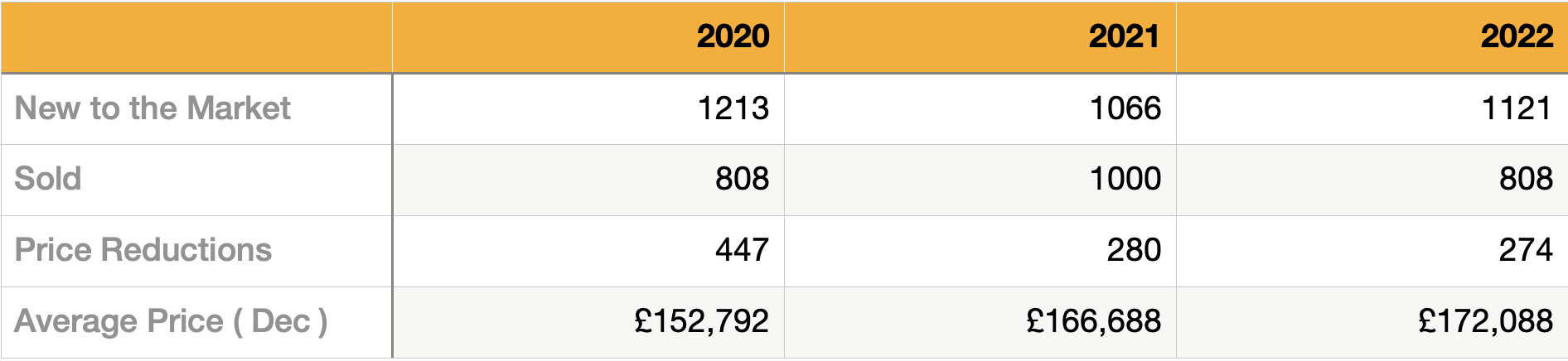

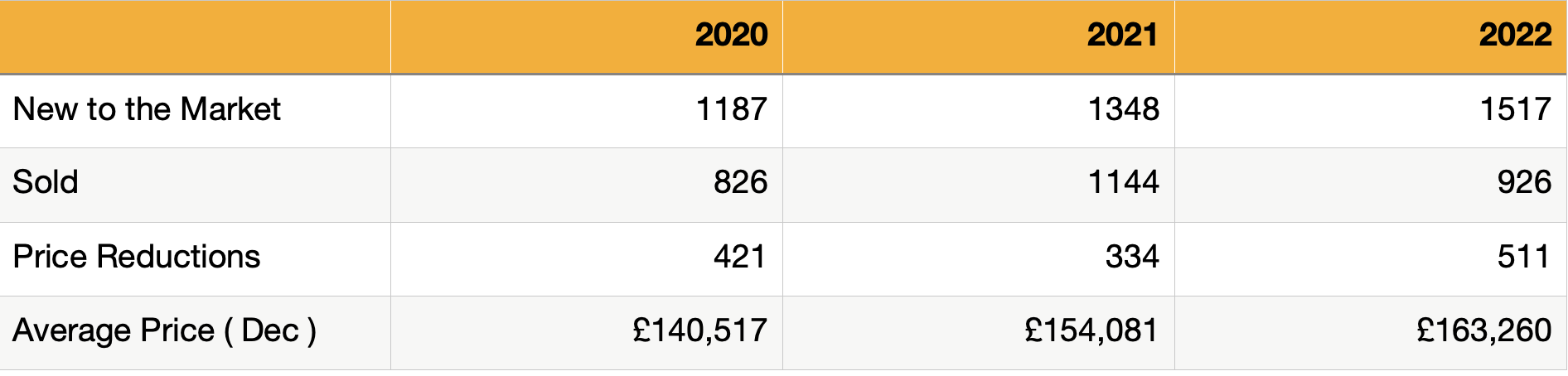

At JDG we like to look at the market at a local level, so you can have a better understanding of what is really happening locally. Here are your property facts.

With Covid restrictions now fully lifted, more homeowners across Lancaster and Morecambe chose to list their homes for sale. There were all sorts of reasons, a key one being that many people realised they had more equity in their homes than they had first realised. For many, moving was more cost-effective than extending and improving their current home. Many landlords also chose to sell, many, because they were simply fed up with all changes to the rental market and the increase in house prices, was a great incentive to dip out now.

The number of new properties coming to the market grew across Lancaster and Morecambe, up by 5.5% in Lancaster and a whopping 12.5% in Morecambe.

Sales in both Lancaster and Morecambe fell back by approximately 20%. Less people were looking. It had to slow given the high activity levels seen in 2021. Buyers also now have more choices and in many ways, this creates a healthier market. Morecambe is one to watch for 2023, with a lot resting on what happens with the Eden Project North decision.

We also saw house price growth slow. In November the Halifax bank reported that property prices had dropped by 2.3% across the UK.

February 2022

The bank of England voted to increase the base rate to 0.5% in an attempt to curb inflation. This would be just one of many increases throughout the year. By mid-December 2022 this rose to 3.5% affecting people's mortgages in terms of how much they could borrow and their monthly repayments.

War also broke out in Ukraine. The impact of this on the World economy was yet to be seen.

March 2022

The cost of living crisis starts to bite. Petrol and Diesel prices are at all an time high and it announced that inflation is the highest it has been in 30 years. We start to see less buyers looking for homes in the countryside and more people want to live closer to the city, the places they work and nearer schools.

June 2022

Despite increasing mortgage rates and the cost of living crisis, property prices still rise, defying all expectations. There is a huge shortage of properties in the rental market, with the average property receiving over 30 applications.

September 2022

In early September, in the span of 48 hours, the U.K. lost its longest-reigning monarch, saw a king—the first in 70 years—ascend in her place, and watched a new prime minister take office. The latter would read havoc over the next 44 days and have the biggest impact on the UK economy and the UK Housing Market.

On a positive note, the now infamous mini-budget saw the level at which you pay stamp duty change again meaning that homeowners that only own the house they live in, do not have to pay stamp duty on purchases below £250,000. For first-time buyers, this level is higher at £425,000.

October 2022

UK house prices fell for the first time in more than a year in October, as the Liz Truss government’s mini-budget had a major impact on the housing market, pushing mortgage rates sharply higher. The Nationwide reported a fall of 0.9% in property prices compared to the previous month and the largest fall since July 2020.

We also saw more buyers looking for energy-efficient homes, questioning a home's EPC and favouring homes with better energy efficiency. We expect to see this trend continue.

November 2022

Across the UK, some buyers start to act like it is 2007 making low offers on homes sometimes as high as 10% less. The Halifax however announce that prices have dropped by just 2.3%. This means that property prices across Lancaster and Morecambe are still higher than they were in the Spring of this year. Explaining what was really happening became more important than ever when talking with clients.

December 2022

Various economists, bank and building societies make their price predictions for 2023. All predict that prices will fall. Predictions vary from 4-8%. However, the Halifax which is highly regarded by many predicted by as much as 8%. Should this happen, it will only take prices back to where they were in December 2021.

On a positive note, Mortgage rates also start to fall back giving renewed hope to those that want to move in 2023 with some attractive fixed rate deals re-appearing around 5%.

The 4 most expensive homes to sell in 2022 are as follows.

1. Tuften Warren, Haverbreaks. 2022 saw the sale of Brettargh Drive, one of Lancaster’s most expensive and beautiful homes. At 8813 sqft it is an exceptionally large home which stands on beautifully manicured grounds. It was advertised at £2,750,000 which equates to £312 per sqft.

2. Oaklands Court, Aldcliffe. A detached home which was advertised at £1.15 million. It was a large house at 5260 sq ft and has fabulous countryside views. The sale is currently proceeding. The price per sqft equates to £218.

3. Uggle Lane, Scotforth. This is a very modern house built to Passiv standard. It’s on the market for £850,000 having had its asking price adjusted in May 2022. It is also SSTC so it will be interesting to see what price it completes at. It measures a respectable 3891 sqft which also equates to £218 per sqft.

In total there were 36 property sales above £500,000 across Lancaster and Morecambe. This was up from just 19 sales in 2021!

In 2022 there were 2638 new instructions across Lancaster Morecambe (LA1, LA3 and LA4). In total 1734 homes went under. This equates to just 65% of all homes. In 2021 it was 88%. This clearly shows how the housing market is becoming more competitive and is something that all home sellers need to be aware of. In the year 785 properties reduced their asking price - this equates to 30% of all properties.

The outlook for 2023 is looking positive despite the increased mortgage rates, rising inflation and the cost of living crisis. Demand is still high. We already have over 30 viewings booked in the diary for the first week in January. We all know property prices have dipped, but as we said previously even the worse case predictions only take us back to where prices were 12 months ago and nobody was complaining then!

At JDG we are looking forward to the year ahead. As the UK’s No.1 Estate Agent ( officially named by The Property Academy in the Best Estate Agent Guide for the 2nd year running), we are once again well-positioned. We research the market heavily and share our market insights with our clients. We are well-known as the home of property data for Lancaster and Morecambe.

Whilst 50 estate agents were involved with the 1734 property sales, we are proud that 15.3% of home movers trusted our agency with their sales in 2022. We are also proud that as well as being the biggest selling agent in the area, our award has been won for the high levels of personal service we give and the exceptional marketing we offer. We’ve always said at JDG we do things differently and now we can clearly prove that the way we do things works!

If you would like to chat about moving home in 2023 or you are a landlord with a property to let, please get in touch. At JDG we are here to help.

Thanks for reading and have a great new year!

Michelle x

PS. If you want to see what is selling throughout 2023, check out our Facebook page. We believe in transparency and we post the sales as they happen. The buyers are out still there. If you want to track the market, check out the Market Reports on our website which are updated on the 1st of each month.

PPS. The photo below shows the moment we were awarded the 2023 trophy as the BEST Overall Estate Agent for both sales and lettings in the UK. The great news for you is that you know when you work with us, you are getting the best estate agent for you and your property! Also featured in the photo is Judge Rinder, David Jones from Sky Sports and Jason Tebb, the head of On The Market.